Startup Monday: Latest tech trends & news happening in the global startup ecosystem. Issue 59 – May 8, 2022.

To have this newsletter emailed to you, sign up here. Plus, listen now to Startup Monday on Apple Podcast | Spotify | Anchor

Top startups news to follow this week:

1. Rivian lands $1.5B incentives package to build massive EV factory in Georgia, Tech Crunch Reports

Rivian will receive a $1.5 billion incentive package to build its massive factory in Georgia, according to documents posted Monday by the state’s Department of Economic Development.

That sizable carrot — the biggest in the state’s history — comes with several commitments from Rivian, including that it will hire 7,500 people who will earn an average annual salary of $56,000 by the end of 2028. Under the agreement, Rivian has agreed to the continued maintenance of these jobs through 2047. Rivian has to make repayments to the state and joint development authority (JDA) in any year in which it is 80% below its maintenance.

Rivian also agreed to invest $5 billion into the factory project located near Atlanta during that same timeframe.

The incentives package is comprised of a mix of tax credits and other subsidies. State and local incentives totaled $1.28 billion. An additional $198 million in site and road improvements is also part of the package. The state and the joint development authority are contributing the 1,978 acres of land for the project, which is worth an estimated $83 million.

The state is also spending about $26.7 million to provide a rough-graded 500-acre pad for Rivian and $2.77 million on survey, design, and permitting for all site development costs. The state and its Department of Transportation will also cover $47 million-plus a $4.67 million in contingencies for road work that includes road widening, traffic signals, and a new interchange.

2. Teleport nabs $110M to provide identity-based infrastructure access

Teleport, a platform that assigns identities to hardware, software, and users to replace the need for passwords, today announced that it raised $110 million in a Series C fundraise at a $1.1 billion post-money valuation. Bessemer Venture Partners led the tranche with participation from Insight Partners, Kleiner Perkins, and S28 Capital, which brings Teleport’s total raised to $169 million.

Co-founder and CEO Ev Kontsevoy says that the capital from the new round will be put toward product development and expanding the size of Teleport’s team from 200 people to around 300 by the end of the year. “The important aspect of growing our product is making Teleport more accessible,” he told TechCrunch via email. “In addition to constantly improving the open-source and enterprise self-hosted downloadable versions, we will continue to invest in making our cloud-based offering globally available.”

Kontsevoy co-founded Teleport (formerly Gravitational) with Taylor Wakefield and Sasha Klizentas in 2015, with the goal of creating a product that could manage access to Kubernetes clusters. (Kubernetes clusters are a group of nodes, or worker computers, that run apps packaged with the necessary dependencies and services.) Wakefield had just exited two startups he’d helped to co-launch, including Mailgun (which was acquired by Rackspace in 2012), while Kontsevoy — a fellow Mailgun co-founder — was coming off a tenure as director of product at Rackspace. Post-Mailgun-acquisition, Wakefield also did a stint at Rackspace, where he was the site leader for the San Francisco office.

3. Nokia-backed VC invests in crypto-mining network

NGP Capital is a Silicon Valley venture capital firm funded by a single limited partner, Nokia. Recently, the firm announced an investment in Nova Labs, formerly Helium, the company that created the HNT cryptocurrency and a way to let wireless networks mine it.

“Nokia felt this was an interesting approach to building networks in a world where network building has become expensive,” said NGP Capital partner Upal Basu. Basu said Nokia sees the Helium network as a potential complement to traditional wireless, since it can offload carrier traffic.

So far, Nova Labs’ peer-to-peer network has primarily been used to offload IoT traffic from LoRaWAN. Compatible hotspots transmit using an open-source wireless networking protocol called LongFi, which can communicate with LoRa modules.

Companies that want to track connected assets pay to use the Helium network. One customers is scooter operator Lime, also an NGP Capital portfolio company. Another Nova Labs customer is Goodyear, which wants to monitor tires using the network, Basu said. Like NGP Capital, Goodyear Ventures was an investor in Nova Labs’ latest financing round.

4. Venture Capital Investment Market Report 2022-2027 | Size, Share, Top Companies, Growth and Industry Trends

According to IMARC Group’s latest report, titled “Venture Capital Investment Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027”, the global venture capital investment market reached a value of US$ 211.3 Billion in 2021. Looking forward, IMARC Group expects the market to reach US$ 584.4 Billion by 2027, exhibiting at a CAGR of 20.1% during 2022-2027.

The competitive landscape of the venture capital investment market has been studied in the report with the detailed profiles of the key players operating in the market.

Some of these key players include:

- Index Ventures

- Accel

- Sequoia Capital Operations LLC

- First Round Capital LLC

- Bessemer Venture Partners

- Founders Fund LLC

- Ggv Management L.L.C.

- Andreessen Horowitz

- Union Square Ventures LLC

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global venture capital investment market report, along with forecasts for growth at the global, regional and country level from 2022-2027. Our report has categorized the market on the basis of sector, fund size, funding type and region.

Breakup by Sector:

- Software

- Pharma and Biotech

- Media and Entertainment

- Medical Devices and Equipment

- Medical Services and Systems

- IT Hardware

- IT services and Telecommunication

- Consumer Goods and Recreation

- Energy

- Others

5. Food security & sustainability drove $2.6b in funding for Ag Biotech in 2021

Venture capital investors pumped $51.7 billion into agrifood technologies in 2021; an 85% increase over 2020. The theme of the year: doubling-down (and tripling, and quadrupling-down.) Agrifoodtech sectors that took off in response to the Covid-19 pandemic not only remained the most popular investment categories; they exploded with new deals.

Agricultural biotechnology startups raked in $2.6 billion across 209 deals in 2021 according to AgFunder’s 2022 Agrifoodtech Investment Report.

It 2020, the Ag Biotech category was one of the fastest growing in the farm tech sector, raising $1.6 billion across 173 deals. Its continued growth between then and now illustrate the rising interest in more sustainable crop and animal health solutions versus their traditional chemical-based counterparts.

Ag Biotech is an AgFunder-defined category which includes companies developing biological inputs for crops, animal health solutions, and those working with seed and animal genetics, among other areas.

Driving factors

Ag Biotech solutions have the potential to increase crop productivity and improve animal health, both of which are crucial to global food security. The UN Population Division estimates that by 2050 there will be 9.7 billion people on Earth to feed, or roughly 30% more people than there were in 2017.

Pesticides, herbicides, and other inputs can aid against crop losses, but at great cost to the environment and human health. Ag Biotech companies developing less-harmful biological alternatives therefore have a significant opportunity before them.

Inflation, the conflict in Ukraine, and continuing Covid-19 supply chain disruptions have also driven up the cost of inputs and threatened yields, while the ongoing ‘bird flu’ outbreak in the US is also spotlighting the need for better animal health solutions.

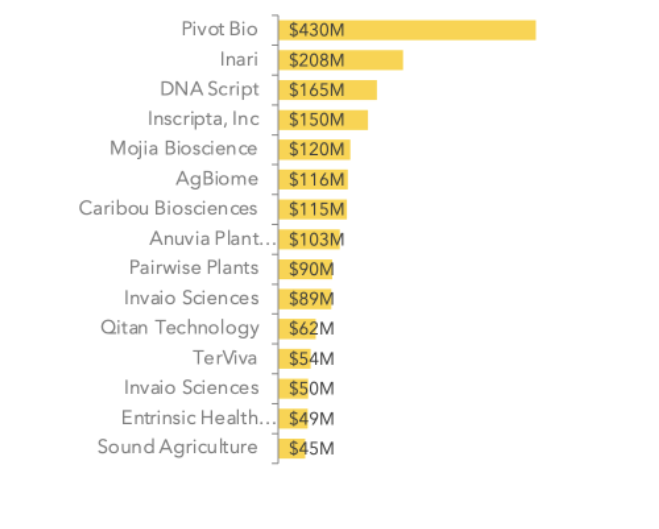

Top 15 Ag Biotech deals 2021

6. Copenhagen-based Januar secures €6 million to launch compliant crypto gate for European business, report EU-Startups

Crypto isn’t going anywhere. It’s become a universal currency and there are few markets where it’s not becoming a normalised financial option. Januar, based in Copenhagen, wants to meet the European appetite for crypto and facilitate its use.

Raising one of Denmark’s largest seed rounds ever, the young startup has just bagged €6 million in a round led by Element Ventures, with participation from Angular Ventures, Outward VC, and early pre-seed backers byFounders. The round also includes well-renowned angel investors including Nicolas Julia, co-founder and CEO of Sorare, Charlie Songhurst, former Head of Strategy at Microsoft, Pierre-Antoine Pierre, CEO and Founder IBanFirst, Jørgen Horwitz, former Director of Finansrådet as well as Einar Braathen from CoinFund.

Founded in 2021 by ex-Chainalysis compliance experts, crypto entrepreneurs, and fintech veterans, Januar is on a mission to support a more open and collaborative financial system based on decentralized technology by offering fiat-to-crypto rails as a service. The company is aiming to meet the growing demand in Europe for such a service.

Simon Ousager, CEO and co-founder of Januar explained: “We are building financial infrastructure that will help crypto companies gain the stable foundation they need to innovate and serve their customers with peace of mind. For years, legacy financial service providers have failed to serve these new digital asset businesses, leaving them at risk of being shut down with days’ notice. It’s time we recognize that entrepreneurs building the future of our financial system deserve an IBAN account, like any other business.”

Digital assets and decentralized transactions are regarded as faster, better and cheaper -and they are shaking up the way value moves between people and businesses globally. But, Europe has been underserved compared to the US when it comes to making the crypto world easier to navigate. Januar meets this need, bridging the gap between the traditional centralized financial system and the new decentralized financial system.

Simon Ousager, CEO and co-founder of Januar continued: “Traditional banks are not ready for what is happening in the crypto markets right now. For many years they focused on the ‘technology’ while writing off the actual category of innovative digital assets – their ‘Blockchain not Bitcoin’ strategy did not align with the market. And while the value and usage of assets, like Bitcoin and Ethereum, multiplied many times over, the dismissive approach of most banks left them with little insights into crypto-specific compliance measurements and an inability to properly serve and support the industry. With Januar, we are here to close that gap now by providing financial services to crypto businesses and crypto services to financial institutions.”

With this fresh funding, Januar is launching crypto-friendly financial services for businesses across Europe; starting with payment accounts for crypto businesses. The fintech startup is well-positioned to do so after having obtained its first-of-its-kind Payment Service Provider license with the Danish FSA, including crypto-specific risk, compliance, and AML policies.

7. Lithuanian fintech startup kevin. banks over €61 million to disrupt payments sector and unlock open banking, reports EU-Startups

The payments sector is undergoing many changes. New innovations, new customer demands and new purchasing habits have made this sector one full of exciting new developments. Now, there’s another big story in this space. Vilnius-based fintech startup kevin. has just secured over €61 million in its mission to shake up the sector.

The Series A round was led by Accel, with participation from Eurazeo and previous investors that include OTB Ventures, Speedinvest, OpenOcean and Global Paytech Ventures. The round also includes angel investors like Harry Stebbings, Ilkka Paananen and Amitabh Jhawar.

Founded in 2018, kevin. has a clear aim: to offer innovative payment solutions that cut out the middle man. The fintech firm provides a secure and developer-friendly payments infrastructure that’s accessible via an API. The innovative approach gives businesses the ability to accept payments directly from banks, cutting out the card networks and making the payments process cheaper, faster, smoother and more convenient.

On a mission to disrupt the payments sector, and unlock the potential of open banking to a wide range of market players, kevin. has been growing at an impressive pace. The firm’s banking payments solutions are fully compliant with the PSD2 framework and are licensed to operate across the EEA.

Recently, the startup has also entered the realm of payments at point-of-sale terminals in physical stores, introducing the first NFC A2A payment solution with a seamless user experience comparable to that of a card payment. The uniqueness of kevin.’s solution is that it doesn’t require any technical change by the merchant, it simply uses the existing infrastructure and the most commonly used NFC payment tech.

The company has had an existing year, having now grown to over 170 employees spread across 30 countries. With this fresh funding, the team will continue to grow – planned to double by 2023 – as well as enter into new markets.

Tadas Tamosiunas, Co-Founder and General Director said: “With this investment, we will continue to expand our international team of experts and developing products that are transforming the payments industry. We have big plans for the future and I’m sure our full suite of next-generation infrastructures for web, mobile and in-store payments will help businesses to gain a competitive advantage.”

8. Andreessen Horowitz plans $500 million investment in Indian startups, reports TechCrunch

Andreessen Horowitz, which made its maiden India investment last year, is looking to get aggressive in the world’s second largest internet market.

The Silicon Valley-based venture capital firm has earmarked about $500 million to back Indian startups, a source familiar with the matter told TechCrunch.

The firm, which led a funding round in the Bengaluru-based cryptocurrency exchange CoinSwitch Kuber last year, is also looking to hire for several investment roles in the country, people familiar with the matter said.

The firm — which in January said it had raised $9 billion for its venture, growth and bio funds — is exploring investment in an Indian startup that operates an opinion sharing platform at a valuation of about $250 million, one person said. It has also engaged with a Bengaluru-headquartered early-stage cross-border payments startup, another person said.

We are “starting to see them look more seriously,” said an investor at a top tier fund in India. He declined to be named.

If the firm, which is colloquially called a16z, goes ahead with the plan, it would be the latest high-profile investor to become actively involved in India, home of 100 unicorns and where tech giants Google, Facebook and Amazon have collectively deployed at least $20 billion over the past decade.

9. Ava sets the example for universal live captioning and raises $10M to keep building, report TechCrunch

When we last checked in with AI-powered captioning service Ava, they had just raised a seed round and it was six months into a pandemic that would reshape how we all work together. Eighteen months later they have investors banging on their door following huge growth, and aim to keep showing the tech industry how deaf and hard of hearing people ought to be included in the hybrid workplace.

The company’s tools provide instant captions for any voice the user hears, whether that’s in a video call, on a Tiktok video or out with friends. (There are different apps and capabilities for each platform, naturally, but they all work together.)

“In the last year and a half since our interview, we’ve grown revenue and client base by roughly 10x, largely as our empowerment products rolled out to users in search for better solutions,” Ava CEO Thibault Duchemin told TechCrunch.

Ava’s approach is to provide a richer and independently configurable captioning tool that works on all content, from podcasts to all-hands meetings to in-person chats, and in such a way that the person can actually make use of it.

10. Daniel Ek pumps $50 million into Spotify: ‘I believe our best days are ahead’

Spotify co-founder Daniel Ek said on Friday that he’s pouring $50 million into the music streaming service, driving its stock price up by more than 3% to a high of $108.98 per share during regular trading hours.

The momentary rise, however, is a blip on the radar for Spotify, which has taken a beating this year — in part over its recent, weaker-than-expected growth forecasts (just like plenty of other streaming and software

As for the reasoning behind Ek’s purchase, the Spotify CEO wants you to know he believes. “I’ve always been vocal about my strong belief in Spotify and what we are building. So I am putting that belief into action this week by investing $50M in $SPOT. I believe our best days are ahead…,” he said, adding that he didn’t have to tell you about it, but wanted to.

Should Ek’s vote of confidence be measured by his other recent equity deals, then perhaps the CEO’s faith in Spotify is surpassed by his support for the military industrial complex. In November, Ek rattled some artists and subscribers when his investment firm, Prima Materia, put roughly $113 million (€100 million) into Helsing. While the artificial intelligence company’s website is sparse, Financial Times reported at the time that Helsing aims to “produce live maps of battlefields.” Along with the nine-figure deal, Ek joined the board of the one-year-old firm, whose customers include the British, French and German militaries.

Have a great news to share? or Feedback? Email at [email protected] . Sign up for The Startup Monday Newsletter

Narine Emdjian, MBA

Federal Funding Expert- Helping startups & academic scientists to acquire federal funding / Podcast Host @hyetechminds