To have this newsletter emailed to you, sign up here. Plus, listen now to Startup Monday on Apple Podcast | Spotify | Anchor

Top startups news and tech trends to follow this week:

1. Startups keep laying off swaths of employees as the downturn continues – TechCrunch

Workforce reductions have impacted startup employees in every massive sector, from crypto to SaaS to edtech and mobility. And what felt at first like a trend that only impacted growth-stage startups that had gotten over their skis, a much wider swath of companies has begun letting employees know they are making meaningful cuts.

TechCrunch listed this week’s known and confirmed layoffs below:

Ro, a healthcare unicorn that lasts raised $150 million just months ago at a $7 billion valuation, has cut 18% of its staff to “manage expenses, increase the efficiency of our organization and better map our resources to our current strategy,” leadership wrote in an email obtained by TechCrunch and confirmed by multiple sources.

MasterClass, an education platform that sells subscriptions to celebrity-taught classes, has cut 20% of its team to “adapt to the worsening macro environment and get to self-sustainability faster,” CEO David Rogier tweeted on Wednesday afternoon. The layoff impacts roughly 120 people across all teams, but no C-suite executives were cut, a MasterClass spokesperson confirmed to TechCrunch.

Voi Technology announced this week that it has cut 35 jobs, or 10% of its staff, to focus on “further increasing” profitability and a goal to reduce headquarter-related costs, per Mathias Hermansson, chief financial officer and deputy CEO at Voi. Meanwhile, Superpedestrian confirmed to TechCrunch that it will be reducing the size of its global team by 7%, impacting 35 employees.

Netflix has laid off 300 people, or around 3% of its workforce, because of slowing growth and the downturn. This is the entertainment company’s third round of layoffs in three months: It let go of 150 staffers in May, a number of staffers for its editorial arm in April, and now is cutting a large chunk of U.S. employees, with some impact on the Asia Pacific, Latin America and Europe, the Middle East and Africa (EMEA), as well.

2. With biotech in retreat, Third Rock raises $1B for life sciences investing

Third Rock Ventures, a prolific backer of biotechnology startups, announced Wednesday the closing of a billion-dollar fund that will be used to launch and build new life sciences companies.

The fund, Third Rock’s sixth, comes amid a significant downturn in the biotech stock market, which has raised questions about the ability of venture firms to secure additional capital as well as returns on their investments. Indeed, the last year or so has seen declines in the two main ways early biotech investors earn returns: initial public offerings and acquisitions.

“It’s been a challenging environment in the last few months,” said Jeffrey Tong, one of Third Rock’s partners. “But on the company creation side … we just have a very loyal base of [limited partners] who are investing across a long-term time horizon.”

3. Raleigh diagnostics startup Gemelli Biotech closes $19M Series A – investors include Carolina Angel Network

Gemelli Biotech Corp. has raised $19 million in funding in a Series A round led by Blue Ox Healthcare Partners.

And Carolina Angel Network participated in the deal as well, along with the company’s founding investor Cedars-Sinai, CerraCap Ventures, and several family offices, according to the company’s statement.

The Raleigh- and Los Angeles-based biotech firm will use the capital to “accelerate the commercialization” of two diagnostic tests, according to its statement.

And, the firm may also “scale up” laboratory and manufacturing capacity and the company’s operational footprints in Raleigh and L.A., it noted in the statement.

4. Zomato acquires Blinkit for $568 million in instant-grocery delivery push

Zomato has acquired Blinkit, a struggling 10-minute grocery delivery startup, in a $568.1 million all-stock deal as the loss-making food delivery firm looks to broaden its offerings at a time when its shares are trading far below last year’s debut price and less than half of the all-time highs.

The deal marks a significant value erosion in Blinkit, which became a unicorn a year ago and had raised about $700 million mostly against equity. When the two firms agreed on an acquisition earlier this year, they had valued the deal between $700 million and $750 million, TechCrunch earlier reported.

The acquisition comes as a relief to Blinkit, which struggled to raise funds from new and most of its existing investors for several quarters.

The SoftBank-backed startup, which was formerly called Grofers, pivoted to instant grocery delivery last year. Blinkit shut many of its dark stores and scaled down the business in many cities earlier this year and pledged to focus more aggressively on 10-minute grocery deliveries. The startup said if its orders can’t reach the customers in 10 minutes, it will not serve in those cities.

5. AI-Powered Hong Kong Biotech Startup Raises $60 Million From Top VCs Including B Capital, Qiming – Forbes states

Hong Kong-based biotech startup Insilico Medicine has raised $60 million in Series D funding from investors including Singapore billionaire Eduardo Saverin’s B Capital Group, private equity giant Warburg Pincus and Midas Lister Nisa Leung’s Qiming Venture Partners.

Other investors in the round include Pavilion Capital, a wholly-owned subsidiary of Singapore’s state investor Temasek, and BHR Partners, a Chinese private equity firm that has backed the likes of ride-hailing giant Didi and electric vehicle battery maker CATL.

To date, Insilico Medicine has raised more than $360 million, including a Series C funding round of $255 million in June last year. The Series C round included investors Sequoia Capital China, Baidu Ventures, Korean billionaire Park Hyeon-joo’s Mirae Asset Capital and former Google China chief Kai-Fu Lee’s Sinovation Ventures.

The Series D funding round is “a testament to the strength of our end-to-end AI platform, which has been validated by many partners, and produced our first novel antifibrotic program discovered using AI and aging research, and designed using our generative AI chemistry engine,” Alex Zhavoronkov, founder and CEO of Insilico Medicine, said in a statement on Monday.

Part of the money raised will be used for the continued development of Pharma.AI, Insilico Medicine’s software platform that helps with drug analysis and experimentation. The funds will also be used to develop a fully automated, AI-driven robotic drug discovery laboratory and fully robotic biological data factory, Insilico Medicine said in the statement.

6. Security-as-code startup Jit comes out of stealth with $38.5M in seed funding

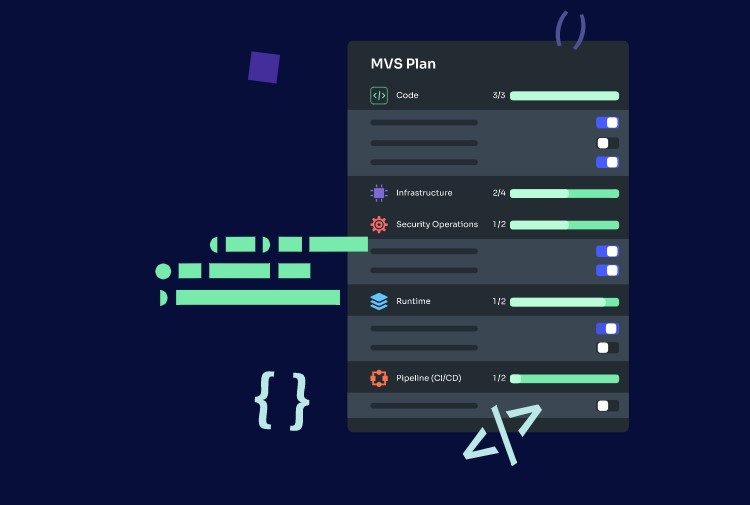

Jit, a startup that helps developers automate product security by codifying their security plans and workflows as code that can then be managed in a code repository like GitHub, today announced that it has raised a $38.5 million seed round led by bold start ventures, with Insight Partners, Tiger Global, TeachAviv and a number of strategic angel investors also participating. The company was incubated by FXP, a Boston-Israel startup venture studio.

Jit, a startup that helps developers automate product security by codifying their security plans and workflows as code that can then be managed in a code repository like GitHub

With this announcement, Jit is also coming out of stealth and announcing the addition of former Puppet CTO and Cloud Foundry Foundation executive director Abby Kearns to its advisory board.

“Cybersecurity leaders are adding more tools, faster than their teams are able to implement, tune and configure them — increasing risk spend,” said Jit CTO David Melamed. “Creating a security plan or program is too time-consuming for high-velocity dev and product teams. Jit streamlines technical security for engineering teams over compliance checkboxes all while reducing spend. We deliver the simplest approach to implementing DevSecOps where product security is built into the software from the start along with a way to continuously maintain it in a language developers understand — code.”

7. Amsterdam cyber startup Hadrian closes €10.5M Seed for a platform that simulates hacker attacks, TechCrunch reports

As companies grow they expose more of themselves online and become harder to defend in terms of cybersecurity. One report estimates that 30%-40% of a company’s IT infrastructure isn’t even known about by the security team.

So startups have appeared with an “offensive” profile in order to simulate cyber attacks.

One such is Amsterdam-based Hadrian, a “hacker-led” cybersecurity startup that offers a SaaS platform that simulates an attack.

It’s closed a €10.5 million seed round led by HV Capital, with participation from Picus Capital, Slimmer AI and angels including Adriaan Mol, Koen Köppen, and Niklas Hellman.

Hadrian’s view is that conventional “pen testing” is time and labor intensive and tends to focus on the areas that companies already believe to be vulnerable. Hadrian’s says its platform scans the company’s infrastructure to look for weaknesses from the outside in to create insights on digital threats and attack vectors.

Rogier Fischer, CEO at Hadrian, said in a statement:

Hadrian understands that CISOs and their teams can’t be expected to attend to every potential threat across the attack surface. Our autonomous technology identifies real threats and prioritizes where action is needed, connecting urgent tasks to existing workflow tools and processes so that the important stuff gets handled first.

8. Cybersecurity startup RevealSecurity raises $23M for global expansion

Cybersecurity startup RevealSecurity revealed today that it has raised $23 million in new funding to accelerate global expansion and product development.

The Series A round was led by SYN Ventures, with Hanaco Ventures, SilverTech Ventures and World Trade Ventures also participating.

Founded in 2020, RevealSecurity offers an artificial intelligence platform that provides cybersecurity protection against insider threats to enterprises. The platform detects malicious insiders and imposters by monitoring user journeys in enterprise applications.

RevealSecurity says its detection is ubiquitous in that it can be applied to any application and across applications, including software-as-a-service and cloud applications as well as custom-built applications. The platform protects enterprise organizations against cases in which an authenticated user is taking advantage of their permissions to perform malicious activities or when an impersonator bypasses authentication mechanisms to pose as a legitimate user.

The company’s platform differs in that it does not rely on application-specific rules but is instead powered by user-journey analytics, combined with a clustering engine to accurately detect abnormal journeys which reflect malicious activities. RevealSecurity argues that rule-based solutions only detect known attack patterns and generate a high number of false alerts, requiring constant investment and maintenance.

9. EuraTechnologies raises €24 million to back deep tech startups and open 10 incubators in Eastern Europe

French incubator and accelerator EuraTechnologies has raised €24 million in funding. Created in 2009, the incubator is a forerunner of French Tech and a model of brownfield rehabilitation.

Going forward, the new investment will allow the French firm to deploy an ambitious roadmap. EuraTechnologies will look at bringing together the world of research and deep tech startups for the region. In line with its main mission of helping create jobs, the incubator will create 3,000 additional permanent jobs on its sites by 2027, through the long-term success of the startups it supports and the companies in its ecosystem.

The company is also looking to invest €10 million in state-of-the-art technological equipment, focusing on a few key sectors such as cybersecurity, agtech and proptech. One of its first planned investments is a cyber range for the cyber campus.

Going green, the Lille-based company wants to become a net zero incubator by 2030. All entrepreneurs at EuraTechnologies will receive net zero training and have access to tools to accelerate their transition.

Halfway between Paris, London, Brussels, and Amsterdam, EuraTechnologies is the gateway to Western Europe for startups in these ecosystems. But now, it is looking at spreading its wings across Europe and moving beyond its home turf. It will open 10 incubators in Eastern European technology universities and in emerging digital ecosystems.

10. London-based Stotles secures €6.1 million to streamline how businesses and governments work together

The Business-to-Government market is vital to the global economy. Aiming to simplify the sector, London-based Stotles has just secured about €6.1 million in Seed funding.

The public sector is a lucrative target market for businesses across the world. Government contracts and government purchases fuel the global economy and they impact society across the board. Building a better way to do business with governments, London-based Stotles has just secured about €6.1 million.

The Seed funding was led by Headline with participation from Form Ventures, GTMFund, Speedinvest, FJLabs, 7Percent, and several prominent angels.

Doing business with the government gives companies a certain status, credibility, and a sense of confidence. And it comes with a lot of competitive energy – just look at the case of Microsoft and AWS who fought ruthlessly over the US government’s JEDI contract. Today, governments are increasingly turning to the private sector to find solutions for global challenges, particularly climate change. In the fight against climate change, more than 50% of spending is flowing from governments around the world and it’s bringing climate tech suppliers immense opportunity to score big-money contracts and transactions.

However, these lucrative deals are not without serious challenges and bureaucracy. This is where Stotles, founded in 2019, is coming in. The startup is aiming to unlock the potential of how businesses and governments work together, streamlining the process for the betterment of all society.

CEO, John Witt, explained: “The business-to-government (B2G) market is the $12 trillion backbone of the global economy. But, this market is in desperate need of some tender love and care. “Every day, we see the painful friction buyers and suppliers have to deal with — fragmented data, complex regulation, heavy compliance, messy workflows. Some call it ‘boring’, but they’re missing the point. This space has been overlooked for decades. By streamlining the business processes that connect business and government, the technology we’re building is capable of saving the world trillions every year – that’s something we get excited about.”

Have great news to share? or Feedback? Email at [email protected] . Sign up for The Startup Monday Newsletter

Narine Emdjian, MBA

Federal Funding Expert- Helping startups & academic scientists to acquire federal funding / Podcast Host @hyetechminds